Graphic:

Excerpt:

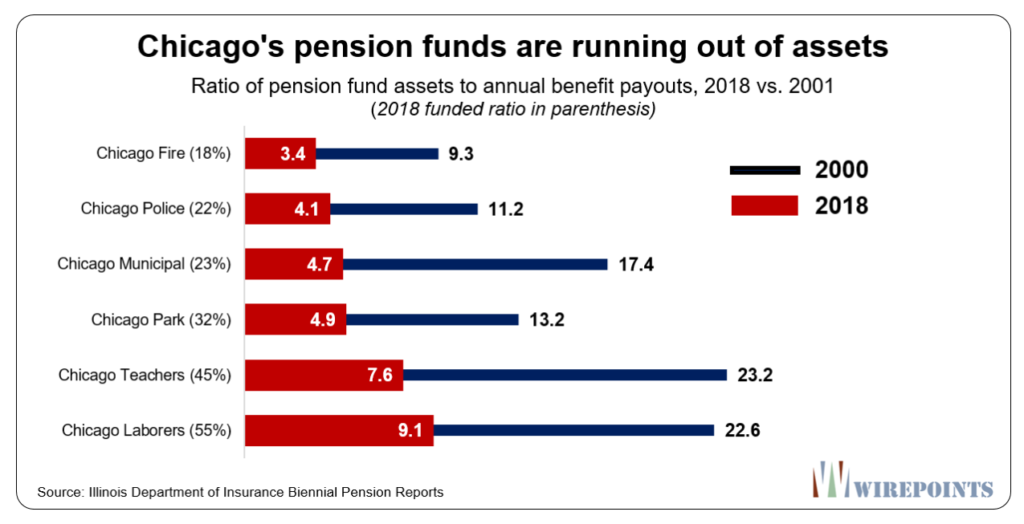

Chicago households are on the hook for a combined $63,000 in Chicago-only debt, based on Moody’s calculations. It’s why the city and the school district have been junk rated for years.

Pritzker’s COLA increase runs against what most of Illinois’ political elite already know – COLA cuts are necessary and inevitable at all levels of government. As Greg Hinz said in his review of Wirepoints’ Pension Solutions, “…that juicy perk over time has amounted to megabillions that state government just doesn’t have.”

The COLA hike will cause more financial headaches for Chicago. Mayor Lori Lightfoot says the COLA increase will cost the city an additional $18 to $30 million a year in pension costs. In all, the perk will force taxpayers to pay an additional $850 million over time.

Author(s): Ted Dabrowski, John Klingner

Publication Date: 8 April 2021

Publication Site: Wirepoints