Graphic:

Excerpt:

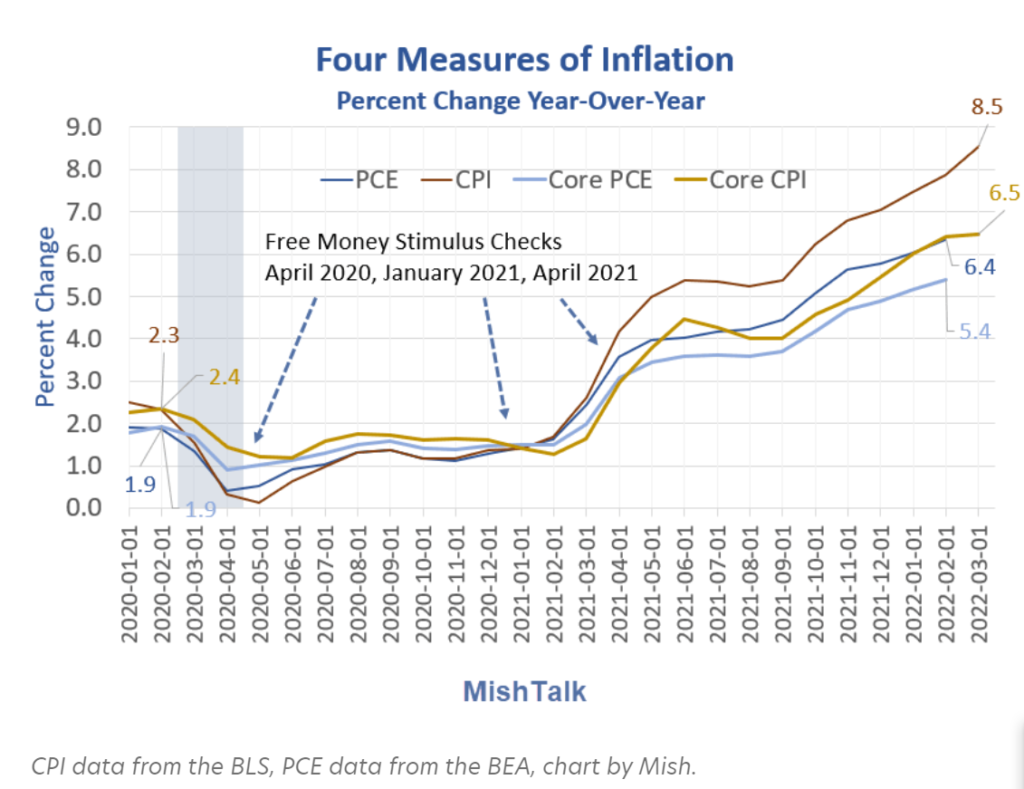

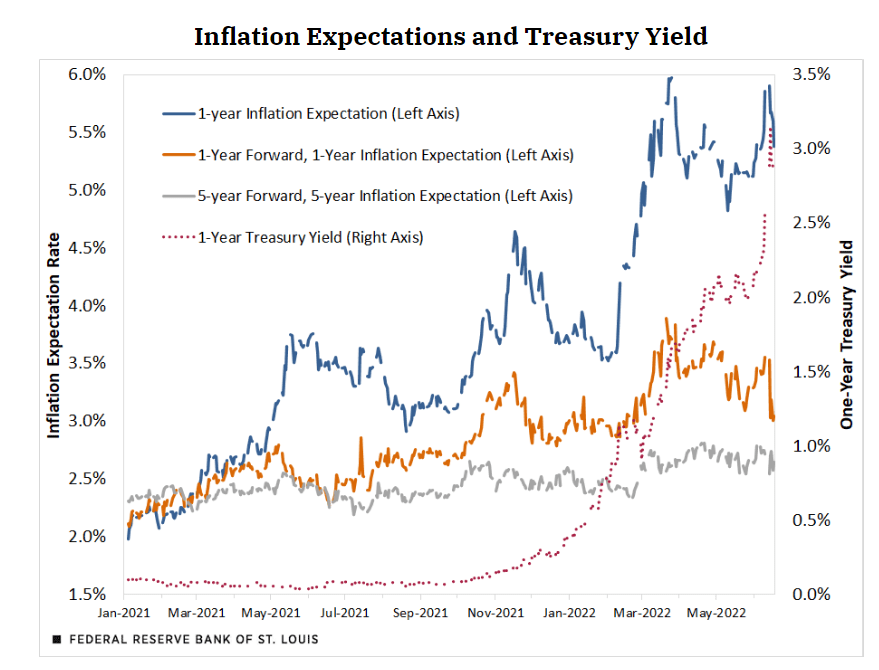

Common sense and practical examples suggest that inflation expectations theory is ass backward.

So much of the CPI is nondiscretionary that it’s difficult to impossible for CPI expectations to matter.

Yet, economists focus on expectations that don’t matter and ignore the expectations that do matter, namely asset prices!

I have written about this several times previously, two of them before I even found the Fed study supporting my view.

…..

A BIS study concluded “Deflation may actually boost output. Lower prices increase real incomes and wealth. And they may also make export goods more competitive.“

Indeed, that must be the case as more goods for less money by default improves standards of living.

The Fed was hell bent on reducing standards of living via inflation. Now they struggle to undo the inflation and asset bubble consequences they created.

The Fed is the problem, not the solution.

Author(s): Mike Shedlock

Publication Date: 25 Jun 2022

Publication Site: Mish Talk