Link: https://www.governing.com/now/heres-why-cutting-gas-taxes-doesnt-work-when-prices-soar

Graphic:

Excerpt:

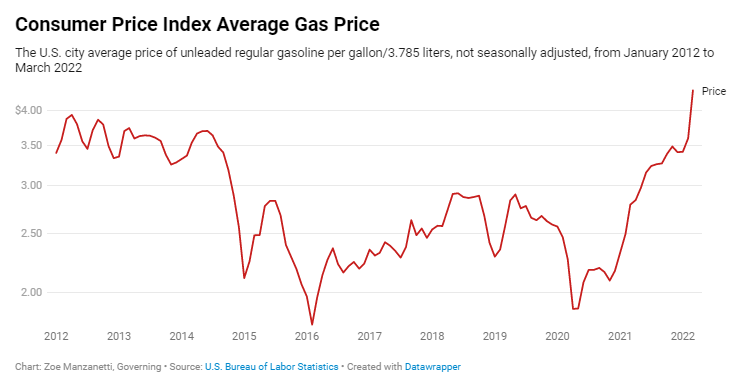

A new report from the Urban Institute catalogs state-level responses and finds that 20 different states have introduced legislation to suspend gas taxes, which are often used to fund infrastructure projects. (Florida, Georgia, and Maryland have already passed gas tax holidays.) There are 16 states considering legislation to provide payments to residents — in the form of tax rebates, credits or stimulus checks — to counteract pain at the pump. Only three are considering changes to help people avoid driving: California, Connecticut, and Hawaii.

“Of the three main categories of policy solutions we could be considering, cutting gas taxes is the worst,” says Jorge González-Hermoso, research associate with the Urban Institute. “It’s very popular, it will get you headlines, but it only creates a simulation that the government is providing a solution.”

González-Hermoso says the problems with gas tax holidays start with the premise that they help consumers. The average gas tax across all states, he reports, is 31 cents a gallon or 7.75 percent of the average price. By one estimate, a driver would have to use 20 gallons of gas a week to save just $30 over the course of Maryland’s one-month holiday. There is no guarantee that station owners wouldn’t pocket the difference, and keep prices roughly the same.

In addition to being ineffective, this policy imperils future infrastructure projects. State and local gas taxes comprise 26 percent of highway spending and often contribute to mass transit as well. They also have the disadvantage of incentivizing driving, as residents in nearby jurisdictions try to take advantage and local consumers know relief is contingent upon buying gas.

Author(s): Jake Blumgart

Publication Date: 26 Apr 2022

Publication Site: Governing