Graphic:

Excerpt:

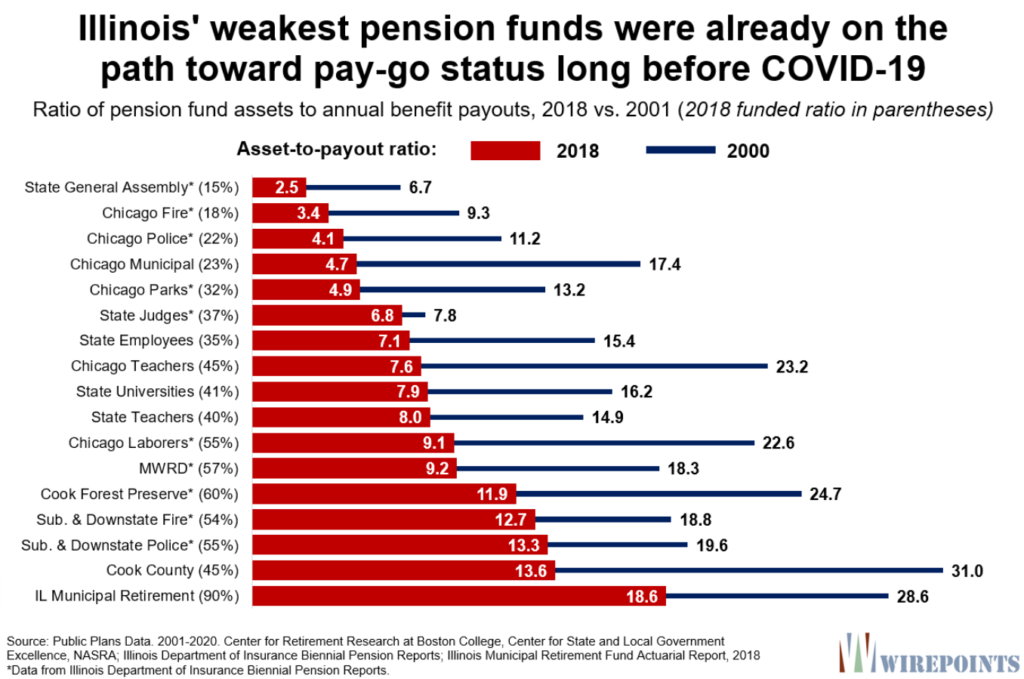

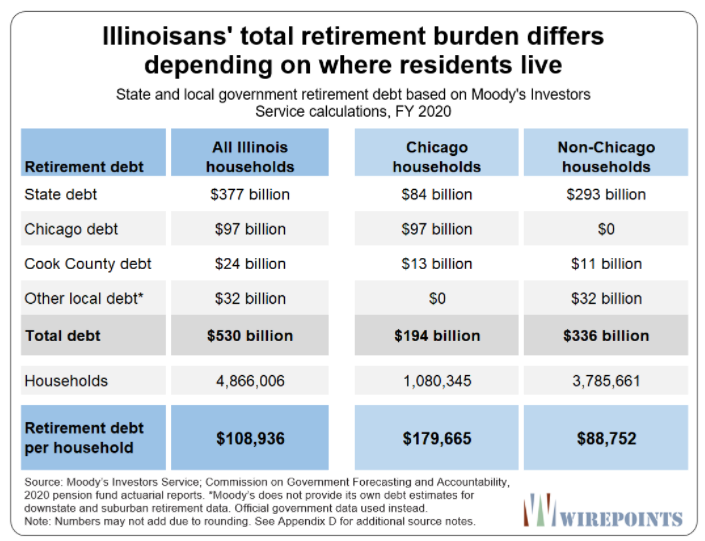

The $110,000 per household is an average across the entire state, but the precise burden for Illinoisans differs depending on where they live. The debt burden on Chicago’s one million households is larger because of the city’s deeper debt crisis. There, each household is on the hook for $180,000 for their share of state and local retirement debts.

Illinoisans living outside of Chicago, meanwhile, face an overall average burden of $90,000 per household. For comparison purposes, the burdens for Chicago and non-Chicago households, based on official state and local retirement debts, are $95,000 and $53,000, respectively.

Author(s): Ted Dabrowski and John Klingner

Publication Date: 17 Nov 2021

Publication Site: Wirepoints