Excerpt:

Moody’s Investors Service (MCO) revised its rating outlook for the Aaa-rated District of Columbia to negative Monday, matching its Friday action on the United States government.

At the same time, the rating agency affirmed the Aaa issuer ratings and stable outlooks of Florida, Maryland and Virginia.

The actions follow Friday’s outlook revision on the United States to negative from stable by Moody’s while it affirmed the U.S. sovereign rating at Aaa.

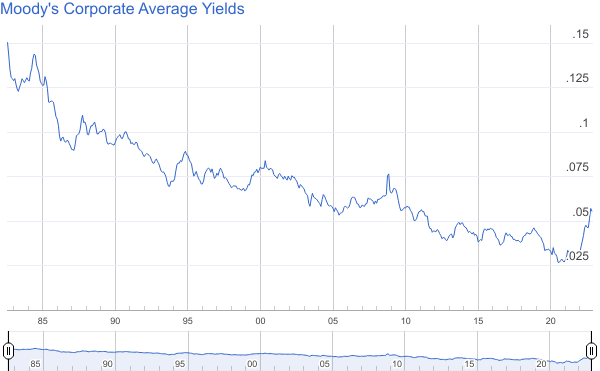

Moody’s said the main reason for the negative outlook on the United States was its assessment that “the downside risks to the U.S.’ fiscal strength have increased and may no longer be fully offset by the sovereign’s unique credit strengths.

“In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues, Moody’s expects that the U.S.’ fiscal deficits will remain very large, significantly weakening debt affordability,” the rating agency said. “Continued political polarization within U.S. Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability.”

Author(s): Chip Barnett

Publication Date: 13 Nov 2023

Publication Site: Fidelity Fixed Income – Bond Buyer