Link: https://www.illinoispolicy.org/hidden-pension-tax-costs-each-illinoisan-more-than-1400-per-year/

Graphic:

Excerpt:

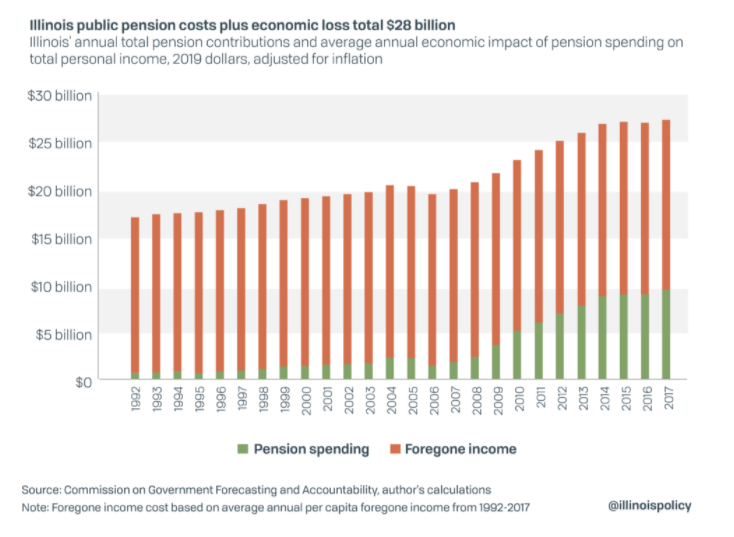

Despite the record increase in pension expenditures in the past several decades, Illinois’ pension system remains the nation’s worst by multiple measures. According to Moody’s Investors Service, Illinois’ pension debt was equal to 500% of the state’s revenues in fiscal year 2018 and almost 30% of the entire state economy, both the highest rates in the nation. At the same time, Illinois’ credit rating has been in precipitous decline and now sits at the lowest credit rating in the nation.

As pension debt continues to increase, so do required pension contributions. Pension contributions now consume 26.5% of the state’s general funds budget, up from less than 4% during the years 1990 through 1997.

Author(s): Orphe Divounguy, Bryce Hill

Publication Date: 2 March 2021

Publication Site: Illinois Policy Institute