Link: https://www.thinkadvisor.com/2022/05/09/covid-19-deaths-continue-to-hit-life-insurers-hard/

Excerpt:

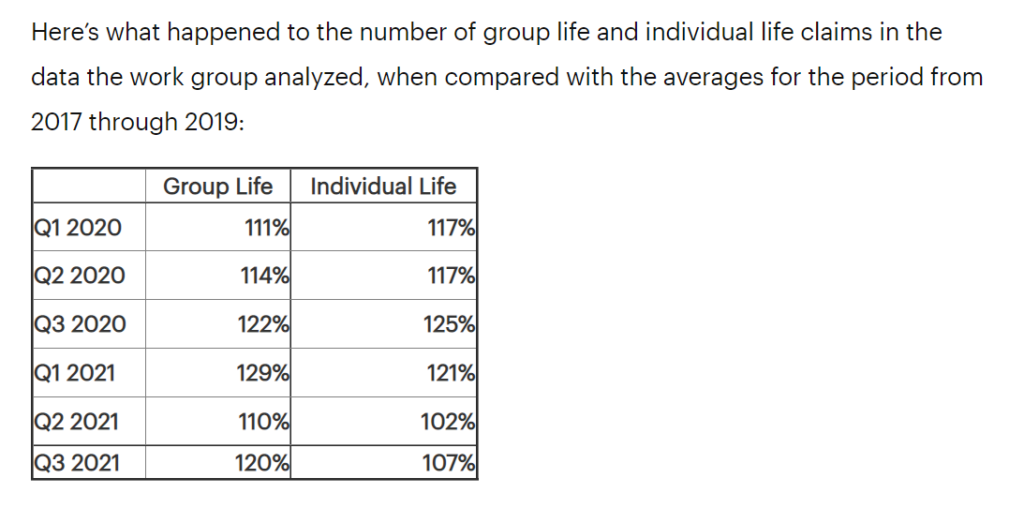

COVID-19 returned to killing older Americans at a much higher rate than younger Americans in the first quarter, and that helped to hold down life insurers’ death claims.

The pandemic killed about 155,000 U.S. residents in the latest quarter. That was up from 127,000 in the fourth quarter of 2021, but down from 191,000 in the first quarter of 2021, according to statistics from the U.S. Centers for Disease Control and Prevention and other public and private sources.

Some life insurers and reinsurers that posted earnings last week skipped COVID-19 mortality details.

…..

MetLife: $230 million in world group life claims this quarter, down from $280 million a year earlier.

Hartford Financial: $96 million before taxes this quarter, down from $185 million a year earlier.

Unum: 1,400 deaths at an average of $55,000, or $77 million, down from 1,725 deaths at an average of $65,000, or $112 million, a year earlier.

Lincoln Financial: $53 million in group life claim claims and $18 million in group disability claims this quarter, down from $83 million in group life claims and $7 million in group disability claims a year earlier.

Voya: $35 million in group life claims this quarter, up from $29 million a year earlier.

Author(s): Allison Bell

Publication Date: 9 May 2022

Publication Site: Think Advisor