Link: https://www.thinkadvisor.com/2022/03/07/why-retirement-isnt-necessarily-the-same-as-not-working/

Graphic:

Excerpt:

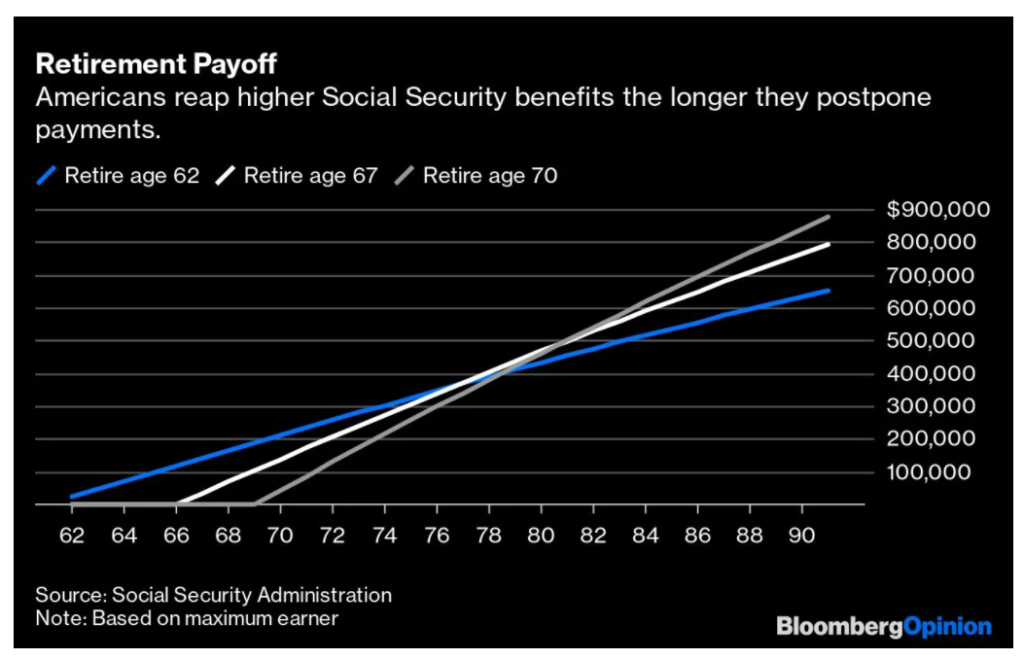

If you claim Social Security at age 70 instead of 62 the sum total of your accrued benefits will be 17% higher if you make it to age 82 (which is the male life expectancy at 62). And remember that’s low risk, inflation-indexed income; there’s no better deal on the market.

Of course, delaying benefits means fewer years collecting them, but if you end up living to your early 80s you’ll come out ahead. The figure below plots how much you’ll get from Social Security (inflation-adjusted and discounted using today’s TIPS curve) at each age depending on when you retire.

And if you already claimed Social Security you can still change your mind and get higher benefits.

But if you are already retired (or resolved on it this year) and the market is down, it may seem like delaying Social Security isn’t an option. After all, you still need to eat.

Author(s): Allison Schrager

Publication Date: 7 Mar 2022

Publication Site: Think Advisor