Link: https://thespectator.com/topic/great-anti-esg-backlash/

Excerpt:

The ESG story starts in 2004, when the three-letter acronym appeared in a UN report arguing for environmental, social and governance considerations to be hardwired into financial systems. Since then the term has been on a long but rapidly accelerating journey from NGO-world obscurity into the financial mainstream and subsequently the political limelight, prompting strong reactions from a chorus of prominent figures. Elon Musk calls it “a scam.” Peter Thiel says it’s a “hate factory.” Warren Buffett describes it as “asinine.”

Unsurprisingly for a piece of UN jargon that has become part of the political cut and thrust, “ESG” is often used to mean different things. Properly defined, it refers to an investment strategy that factors in environmental, social and corporate governance considerations. That might mean not investing in oil and gas companies, for example. Or it might mean only investing in companies that have a stated commitment to diversity, equity and inclusion. As it has grown in infamy, the acronym has also come to refer not only to investment products billed as ESG, but to other practices through which investment firms use their customers’ money to push political ends. For example, your pension may not be invested in an ESG fund, but the manager of that money may still be using stocks owned on your behalf to pursue political goals. A third, even broader, meaning is as a synonym for woke capitalism: a broad catch-all for big business’s embrace of bien pensant opinion, particularly on the environment.

….

This win-win rhetoric has been the rallying cry of the ESG crowd on what has looked like an unstoppable march. Make money and do good: who could possibly object? Millions have bought into this seductive logic. Globally, more than $35 trillion of assets are invested according to ESG considerations, an increase of more than 50 percent since 2016. From 2020 to 2022, the size of ESG assets in the United States grew by 40 percent. According to an analysis by the asset manager Pimco, ESG was mentioned on just 1 percent of earnings calls between 2005 and 2018. By 2021, that figure had risen to 20 percent.

….

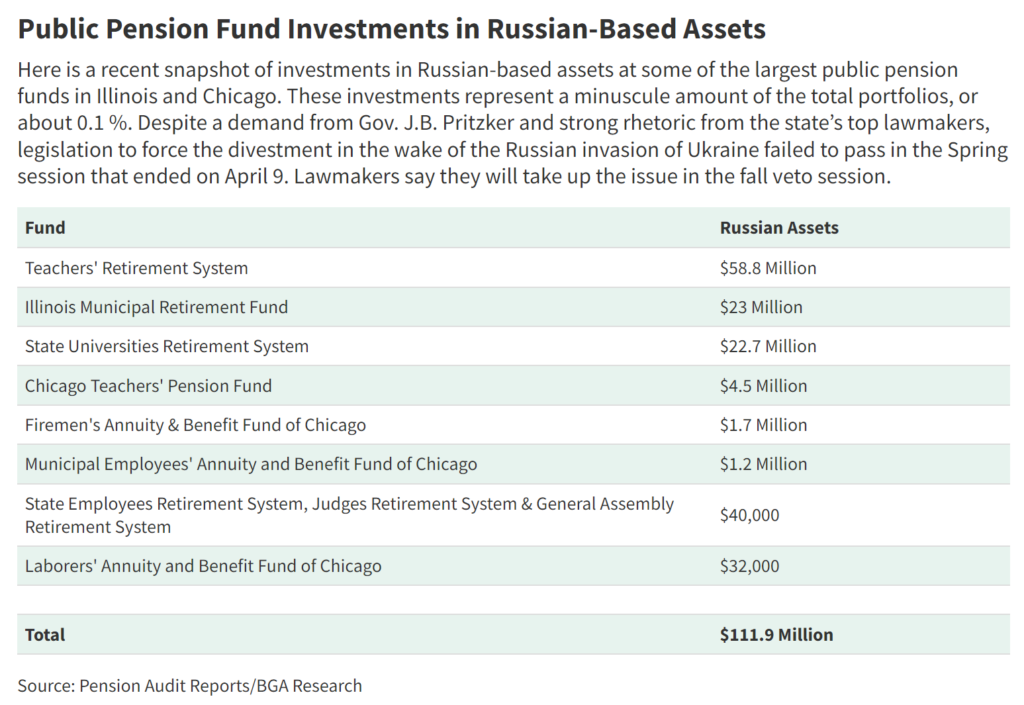

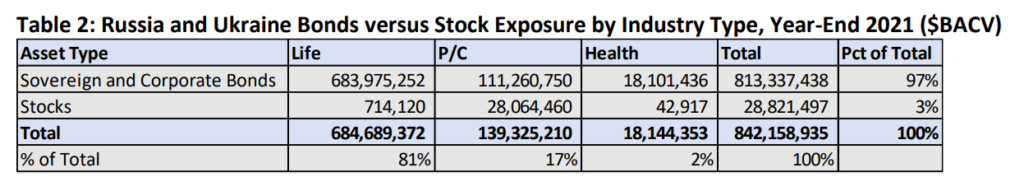

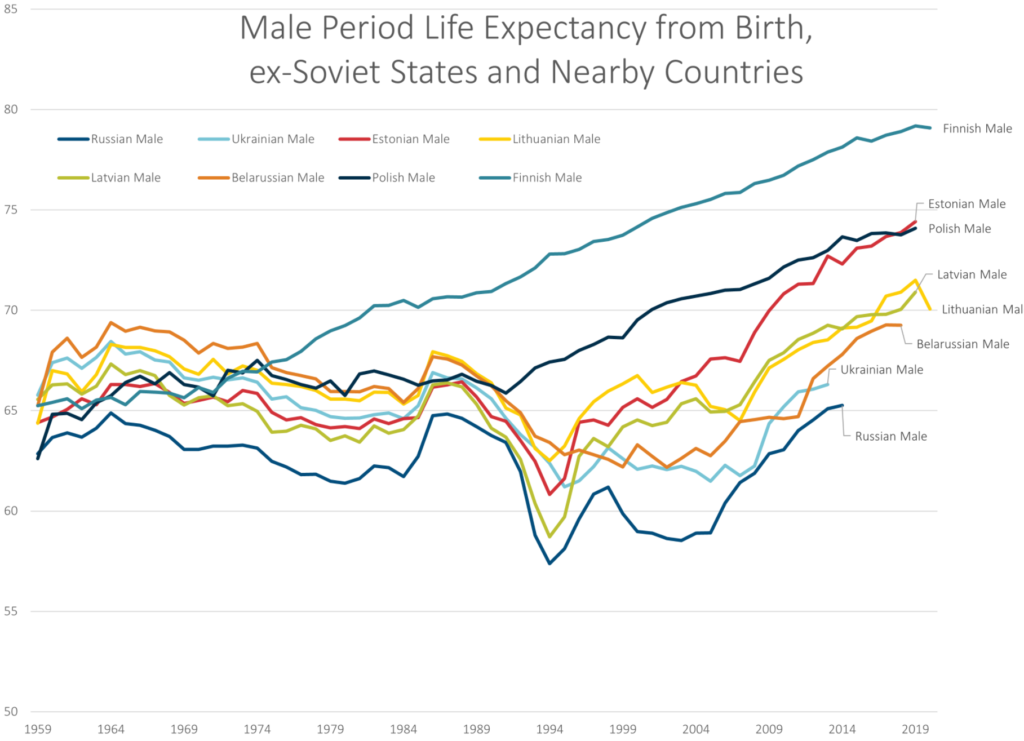

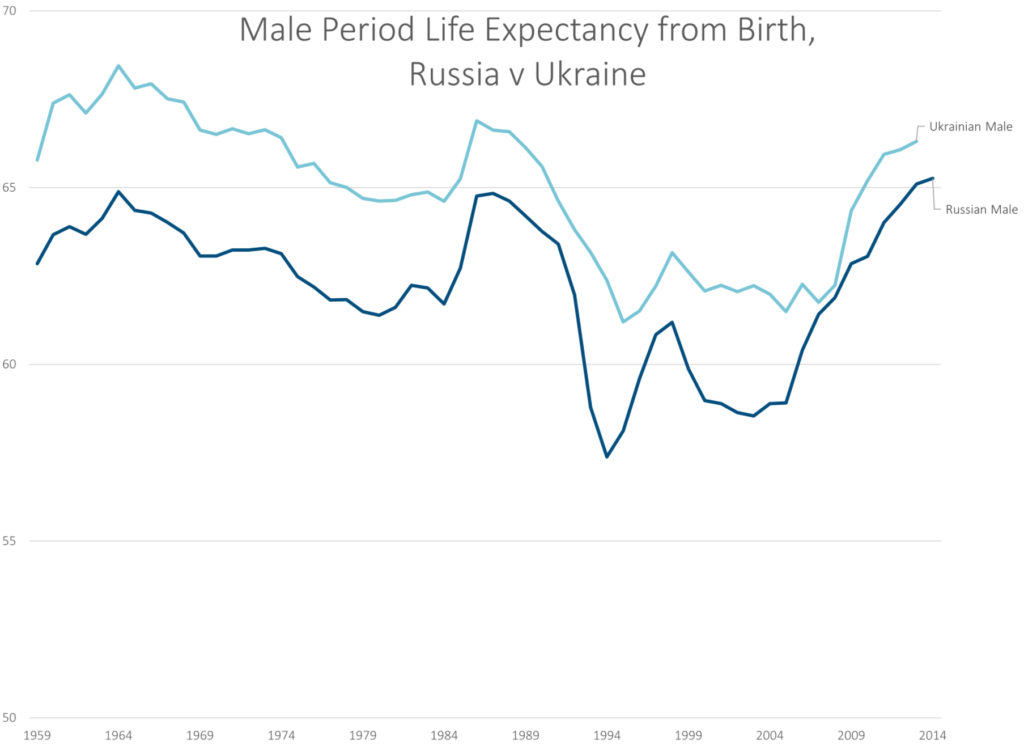

If the anti-ESG movement has the wind in its sails, that’s in large part thanks to last year’s tumultuous geopolitical events and economic trends, foremost among them the war in Ukraine. The Russian invasion has transformed the ESG debate in two ways.

First, it has underscored the ethical dilemmas ESG champions would rather ignore. For example, many ESG funds rule out investment in weapons manufacturers. Is it really ethical to deny capital to the firms producing the material Ukraine needs to survive? Indeed, the socially responsible position is arguably the exact opposite.

Second, it has transformed the energy conversation in a way that has made many more of us acutely aware of the importance of cheap, abundant and reliable energy — and conscious that it cannot be taken for granted. In other words, each of us is a little more like Riley Moore’s West Virginia constituents, who don’t have much time for net-zero grandstanding given that they will be the ones who pay a heavy price for someone else’s pursuit of feel-good goals. What has always been true is becoming clearer: a financial system that starves domestic energy producers of capital not only hurts those whose savings are being used to pursue political ends, but ends up as a de facto tax on US consumers in the form of higher energy costs. ESG, says Goldman Sachs’s Michele Della Vigna, “creates affordability problems which could generate political backlash. That is the risk — political instability and the consumer effectively suffering from this cost inflation.”

Author(s): Oliver Wiseman

Publication Date: 22 Dec 2022

Publication Site: The Spectator