Link: https://www.nytimes.com/2022/09/17/opinion/environment/climate-change-pension-texas-florida.html

Excerpt:

Mr. Read is the Oregon state treasurer.

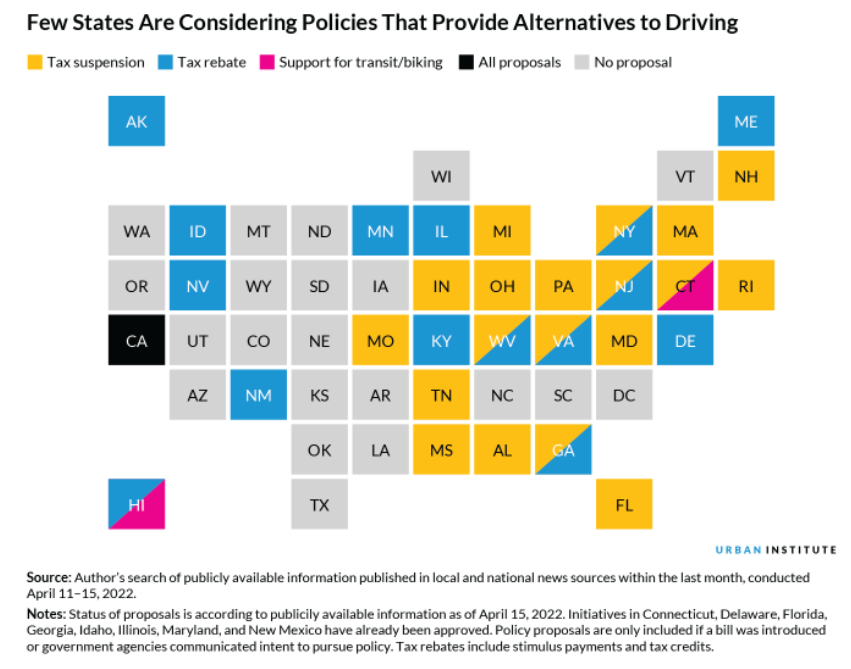

In several Republican-led states, the officials who oversee pension funds for millions of state workers are being told, or may soon be told, to ignore the financial risks associated with a warming world. There’s something distinctly anti-free market about policymakers limiting investment professionals’ choices — and it’s putting the retirement savings of millions at risk.

The Texas comptroller, Glenn Hegar, recently announced that 10 financial firms and 348 funds could be barred from doing business with the state’s pension plans because they appeared to consider environmental risks in their investment decisions regarding the fossil fuel industry. The day before, Gov. Ron DeSantis of Florida announced a similar move. Other states, including Idaho, Louisiana and West Virginia, have either taken or are thinking of taking similar actions, which amount to ideological litmus tests that will likely result in lower returns for pensioners.

Author(s): Tobias Read

Publication Date: 17 Sept 2022

Publication Site: NYT