Excerpt:

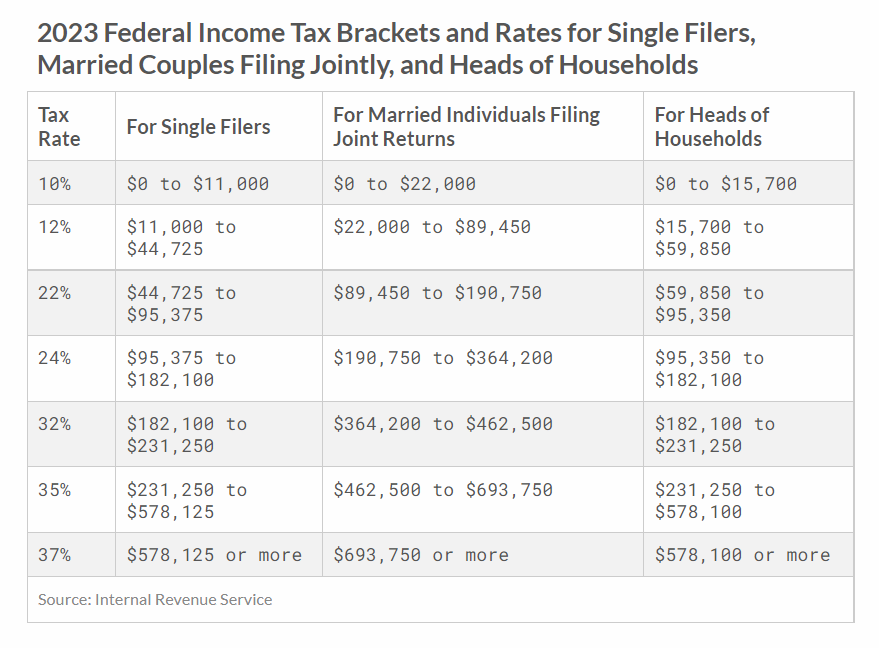

And, as Mary Johnson, the league’s Social Security and Medicare policy analyst, highlighted in a call with ThinkAdvisor, there is also widespread concern about what the relatively modest 2024 COLA could mean for the taxes seniors pay on their federal government benefits.

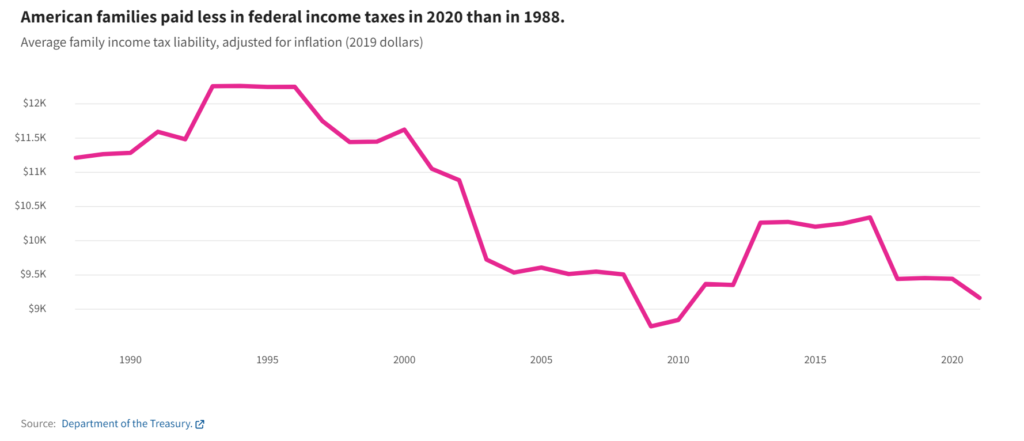

As many as 26% of survey participants who have received Social Security for more than three years reported paying taxes on a portion of their benefits for the first time during the 2023 tax season — i.e., for tax year 2022.

“Because Social Security recipients received an even higher COLA of 8.7% in 2023, we expect more beneficiaries to become liable for federal income taxes on their Social Security benefits for the first time in the upcoming 2024 tax season,” Johnson warned.

….

“Up to 85% of Social Security benefits can be taxable when income exceeds certain thresholds,” Johnson explains. “Unlike other parts of the federal income tax code, though, the income thresholds that subject Social Security benefits to taxation have never been adjusted for inflation.”

Author(s): John Manganaro

Publication Date: 13 Oct 2023

Publication Site: Think Advisor