Graphic:

Excerpt:

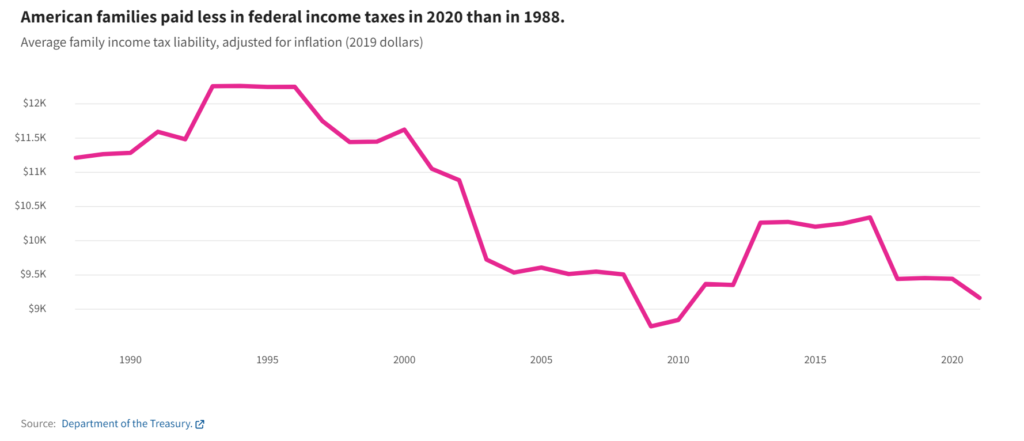

From 1988 to 1993, the average federal income tax bill for American families increased by over $1,000 in 2019 dollars. Families in the top 1%, the middle class and elderly families had increases in their federal income tax bills. But for middle-class families with children, tax bills over that time decreased.

The payroll tax changes caused the average payroll tax liability for employers and employees combined to increase by nearly $400. Payroll tax policy hasn’t changed significantly since the 1993 law.

Publication Date: 26 April 2022

Publication Site: USA Facts