Link: https://taxfoundation.org/inflation-tax-legacy/

Graphic:

Excerpt:

With record inflation now squeezing American household budgets, you can thank our Senior Fellow Emeritus Steve Entin for shielding U.S. workers from being pushed into higher tax brackets. If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

It all started some 40 years ago. After Ronald Reagan was elected President, Steve Entin, who had previously served as a staff economist on the Joint Economic Committee and studied under notable professors like Milton Friedman at the University of Chicago, was invited to work at the Department of the Treasury as Deputy Assistant Secretary for Economic Policy.

As many at the Tax Foundation can attest, Steve’s stories about his time in the Reagan administration are legendary, but one stands out. Steve did something that every household in America should be grateful for—he convinced President Reagan to call for indexing the tax code to inflation.

At the time, American taxpayers were subject to bracket creep, which occurs when inflation pushes taxpayers into higher income tax brackets or reduces the value of credits, deductions, and exemptions. The bracket thresholds failed to keep pace with inflation, resulting in an increase in income taxes without an increase in real income.

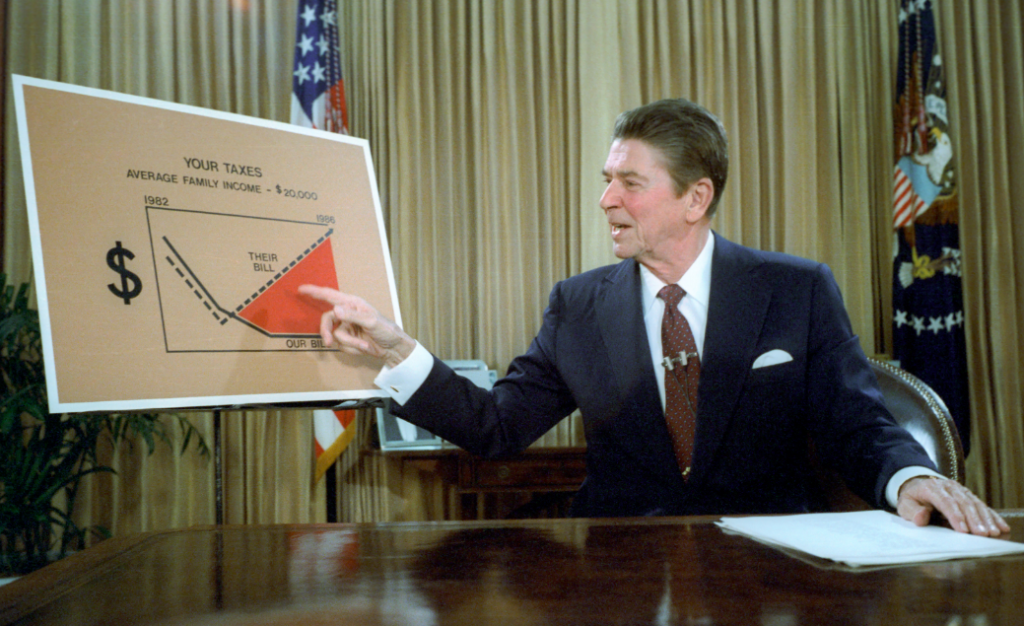

Indeed, President Reagan used the chart that Steve drew for him during a televised address asking Americans to call their members of Congress and demand they index the tax code. People did. And it worked.

Author(s): Scott A. Hodge

Publication Date: 12 Sept 2022

Publication Site: Tax Foundation