Link: https://taxfoundation.org/massachusetts-graduated-income-tax-amendment/

Graphic:

Excerpt:

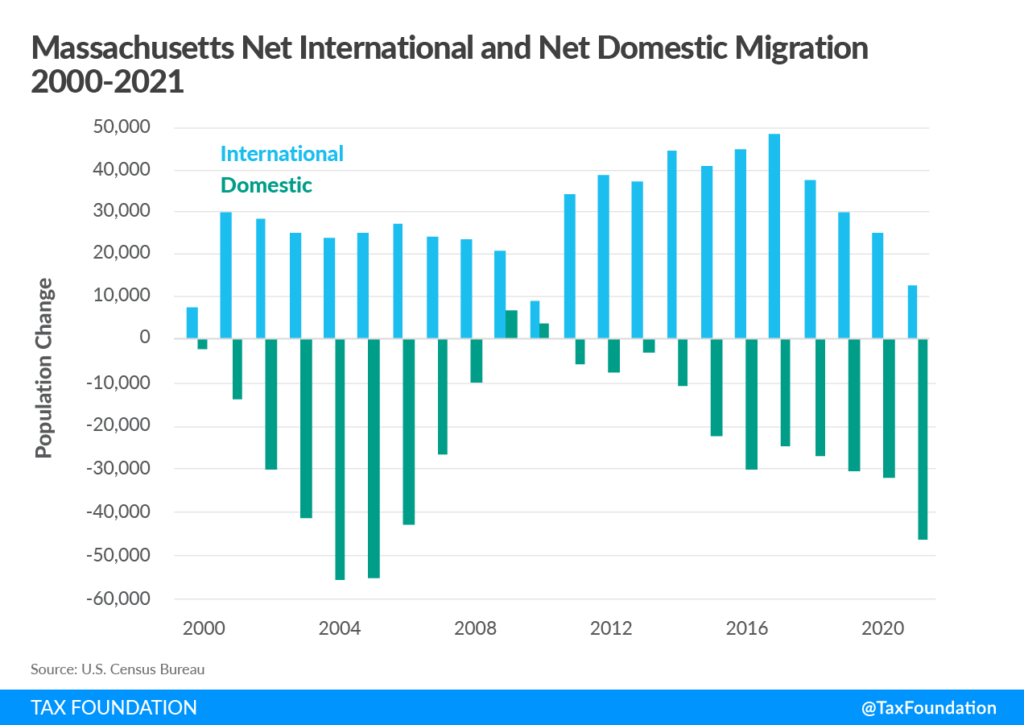

Massachusetts is already trending in the wrong direction in terms of migration. Since 2013, Massachusetts’ net population change levels have been trending downward; and in 2020 the Commonwealth realized its first net negative population change since 2004. Massachusetts lost an estimated 1,309 residents in 2020 but that figure grew to 37,497 by 2021. Much of that change is likely attributable to various changes brought on by the pandemic, including the expansion of remote work opportunities. However, Massachusetts’ struggle with migration precedes the pandemic.

The Bay State’s net migration levels generally mirror the downward trajectory of the net population change figures, but a closer look reveals that Massachusetts was experiencing net negative migration even before the pandemic began. The downward trend for net migration reached net negative levels in 2019, the first year since 2007.

Whether Massachusetts’ net migration figure is positive or negative primarily depends on the strength of net international migration. For 20 of the last 22 years, Massachusetts has seen net negative domestic migration. What this effectively means is that it is preferable to migrate to Massachusetts from abroad, but once a person lives there, it is preferable to move somewhere else. Between July 1, 2020 and July 1, 2021, an estimated 12,675 more people moved to the Bay State from abroad than left for foreign destinations. However, 46,187 more people left Massachusetts for other domestic locations than moved in from elsewhere in the United States.[14] This should concern policymakers, but the figure that should be even more concerning is the net outmigration of adjusted gross income (AGI).

Author(s): Timothy Vermeer

Publication Date: 13 Sept 2022

Publication Site: Tax Foundation