Graphic:

Excerpt:

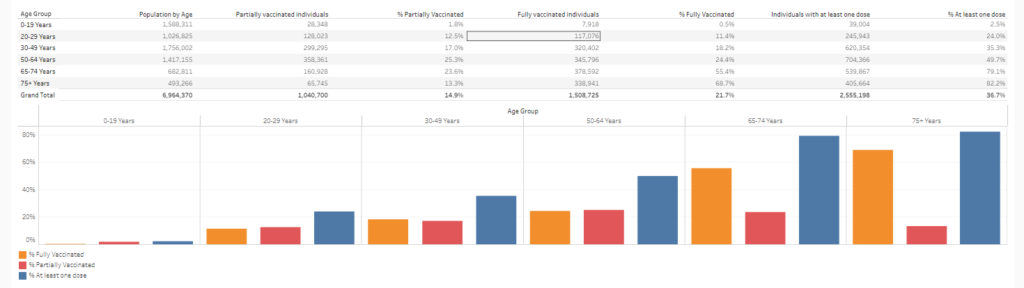

COVID-19 vaccination, particularly the disparity of rates between racial and ethnic groups, takes up much of the current talk about the pandemic. The Massachusetts Department of Public Health (DPH) publishes vaccination data every day, for municipalities, tracking rates by age group, racial and ethnic groups, and by gender.

Pioneer is proud to present a new vaccine tracker, the newest tool in our COVID-19 tracking project. Pioneer distilled the vaccination data down to those who are either fully vaccinated or partially vaccinated, by all the demographic categories published by the DPH. Use the new tool below to compare rates among groups, by municipality and by county. We will update the data every week.

Date Accessed: 20 April 2021

Publication Site: Pioneer Institute