Conference draft: https://www.brookings.edu/wp-content/uploads/2021/03/BPEASP21_Lenney-et-al_conf-draft_updated_3.24.21.pdf

Graphic:

Excerpt:

“Given other demands, fully funding their pension plans might not be the right thing for state and local governments,” Sheiner said in an interview with The Brookings Institution. “They should compare the benefits of upping their pension investments with the benefits of investing in their people.”

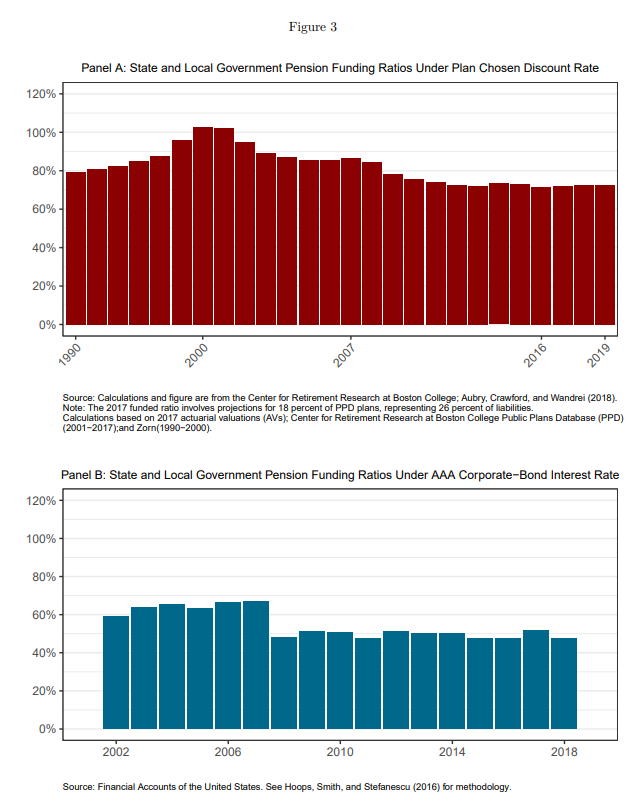

Most research evaluates state and local pension plans on the assumption they should be fully funded—that is, their assets are sufficient to meet all anticipated obligations to current and future retirees. State and local pension plans, benefiting more than 11 million retirees, hold nearly $5 trillion in assets and, according to a recent estimate cited in the paper, would require an additional $4 trillion to meet all of their obligations.

However, in The sustainability of state and local government pensions: A public finance approach, the authors observe that, using the types of calculations that economists recommend, state and local pension plans have never been fully funded—meaning that they have always been implicitly in debt. Furthermore, they show that being able to pay benefits in perpetuity doesn’t require full funding. If plans contribute enough to stabilize their pension debt, that is enough to enable them to make benefit payments over the long run.

Author(s): Jamie Lenney, Byron Lutz, Finn Schüle, Louise Sheiner

Publication Date: 24 March 2021

Publication Site: Brookings