Graphic:

Excerpt:

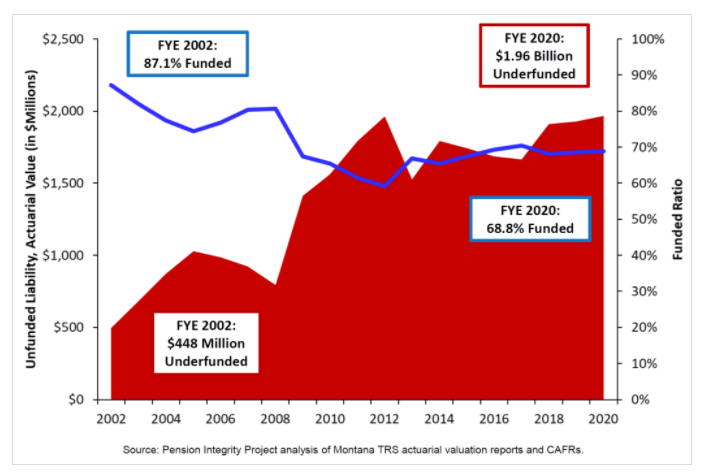

The latest analysis by the Pension Integrity Project at Reason Foundation, updated this month (February 2021), shows that deviations from the plan’s investment return assumptions have been the largest contributor to the unfunded liability, adding $897 million since 2002. The analysis also shows that failing to meet investment targets will likely be a problem for TRS going forward, as projections reveal the pension plan has roughly a 50 percent chance of meeting their 7.5 percent assumed rate of investment return in both the short and long term.

In recent years TRS has also made necessary adjustments to various actuarial assumptions, exposing over $400 million in previously unrecognized unfunded liabilities. The overall growth in unfunded liabilities has driven Montana’s pension benefit costs higher while crowding out other education spending priorities in the state, like classroom programming and teacher pay raises.

The chart below, from the full solvency analysis, shows the increase in the Montana Teacher Retirement System’s debt since 2002:

Author(s): Jen Sidorova, Swaroop Bhagavatula, Steven Gassenberger, Leonard Gilroy

Publication Date: 1 March 2021

Publication Site: Reason