Link: https://www.cato.org/sites/cato.org/files/pubs/pdf/ssp6.pdf

Graphic:

Excerpt:

Given Social Security’s dire financial condition, there is growing interest in attempting to harness the power of private capital markets to bail out the faltering system. However, despite its surface attractiveness, allowing the government to invest funds from the Social Security trust fund in private capital markets would be a terrible mistake that would have severe consequences for the U.S. economy.

…..

Allowing the government to invest the trust fund in private capital markets would amount to the “socialization” of a large portion of the U.S. economy. The federal government would become the nation’s largest shareholder, with a controlling interest in nearly every American company. Government ownership brings with it serious problems of government control and is a threat to the efficiency and competitiveness of the U.S. economy.

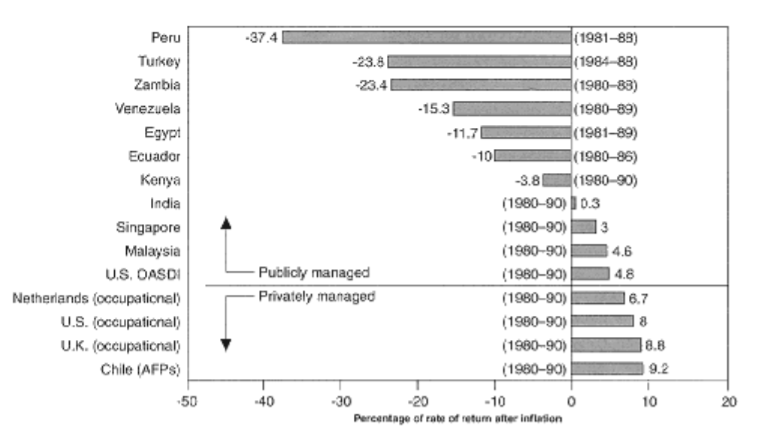

Moreover, experience in other countries has shown that government investments seldom achieve the rates of return

seen in private investment. Attempts by the government to manipulate the markets could further undermine returns and threaten general market stability.

Author(s): Krzysztof M. Ostaszewski

Publication Date: 14 January 1997

Publication Site: Cato Institute