Link: https://www.gardenstateinitiative.org/updates/sustainability

Graphic:

Excerpt:

NJ’s revenue is being produced by higher rates on a smaller tax base: New Jersey needs to ensure that the outmigration of high-income residents does not continue. Between 2008 and 2017, New Jersey experienced growth in the number of tax filers of 4.2%; however, growth in those making $500,000 or more annually was only 2.5% during the same time.

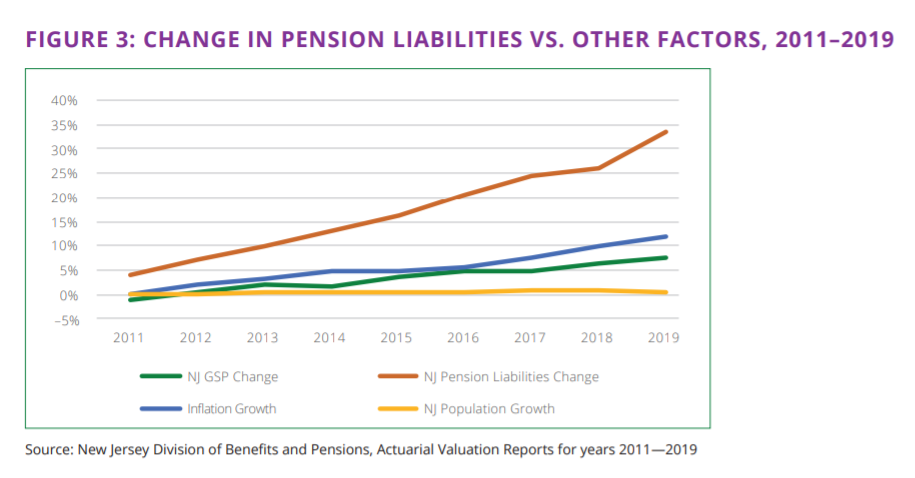

NJ’s public spending is growing faster than inflation, our population or job creation: Our state will continue to see specific needs increase, especially in public health, health insurance, and public safety. New Jersey already taxes residents and businesses more than most other states. The problem is not too little revenue; rather, it is that the state’s spending is growing at a faster pace than inflation and the state’s population

The cost of NJ’s public workforce retirement and healthcare is the key driver of escalating spending and taxes: What New Jersey owes employees and retirees is growing significantly faster than the underlying economy that must support this liability. This is not sustainable. Pension liabilities are growing faster than assets

Author(s): Thad Calabrese, Thomas Healey

Publication Date: 22 Sept 2021

Publication Site: Garden State Initiative