Graphic:

Excerpt:

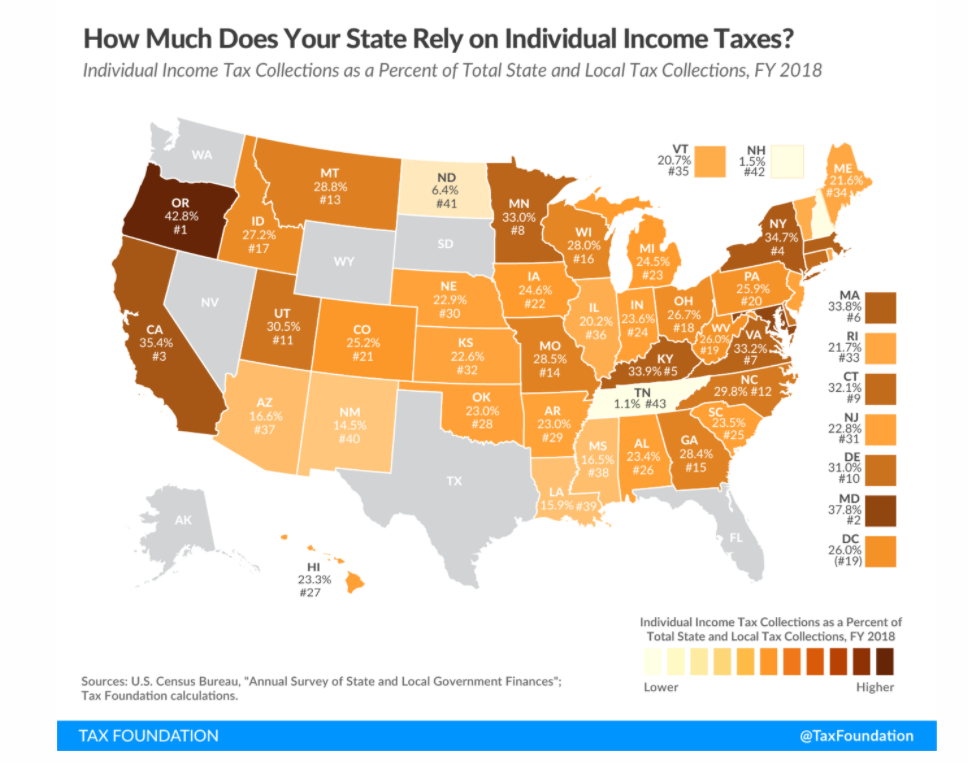

Sources of state revenue have come under closer scrutiny in light of the impact of the coronavirus pandemic, as different tax types have differing volatility and economic impact—although even beyond these unique circumstances, it is important for policymakers to understand the trade-offs associated with different sources of tax revenue. This week’s map looks at what percentage of each state’s state and local tax collections is attributable to the individual income tax.

State and localities rely heavily on the individual income tax, which accounted for 24.2 percent of total U.S. state and local tax collections in fiscal year 2018, the latest year for which data are available. The individual income tax ranks just above the general sales tax (23.3 percent) and behind property taxes (31.1 percent), taking its place as the second largest source of state and local revenue.

Author(s): Janelle Cammenga

Publication Date: 10 February 2021

Publication Site: Tax Foundation