Graphic:

Excerpt:

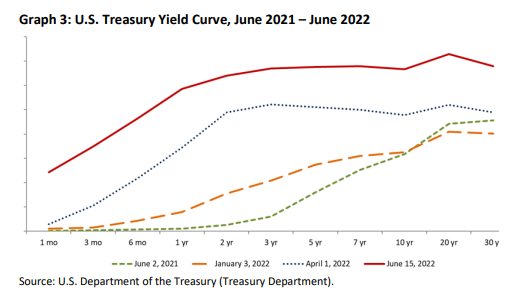

The shape of the Treasury yield curve generally provides insight into the market’s expectations for

interest rates, as well as economic activity. As of June, the yield curve has shifted higher and flattened

compared to the beginning of the year and the last year. The Federal Reserve’s recent aggressive actions

have resulted in the higher Treasury rates and a flattening of the yield curve, as many investors believe

higher rates will push the U.S. economy into a recession. The yield curve also inverted briefly in midJune, which market participants view as a recession signal.As of year-end 2021, U.S. insurers had exposure to about $316.3 billion in U.S. government bonds across

various maturities, or about 6% of total cash and invested assets. This was an increase from $280.6

billion at year-end 2020, but it was unchanged as a percentage of total cash and invested assets.

Author(s): Jennifer Johnson and Michele Wong

Publication Date: 23 June 2022

Publication Site: NAIC Capital Markets Special Report