Link: https://content.naic.org/sites/default/files/capital-markets-special-reports-bankloans-ye2022.pdf

Graphic:

Executive Summary:

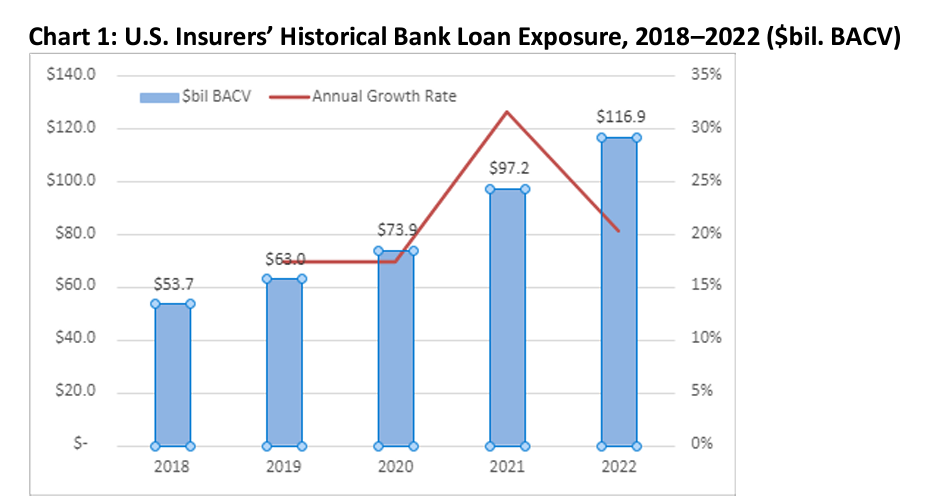

Bank loans were one of the fastest-growing asset types in 2022 for U.S. insurers, increasing by 21% to $117 billion in book/adjusted carrying value (BACV) from $97.2 billion in 2021.

Despite the double-digit growth, bank loans were under 2% of U.S. insurers’ total cash and invested assets at year-end 2022, and about 75% were acquired in market transactions; the remaining 25% were issued by the reporting entities.

Large life companies, or those with more than $10 billion in assets under management, accounted for almost 80% of U.S. insurers’ bank loan exposure, up from 74% in 2021; the top 10 insurance companies accounted for 60% of U.S. insurers’ total bank loan exposure at year-end 2022, up from 54% in 2021.

There was continued improvement in credit quality for U.S. insurer bank loans, evidenced in part by a decrease in those carrying NAIC 4 Designations—i.e., implying a B credit rating—to 26% of total bank loans in 2022 from 33% in 2021, and countered by an increase in bank loans carrying NAIC 1 Designations to 24% in 2022 from 18% in 2021.

Total U.S. leveraged bank loan volume was about $1.7 trillion in 2022, representing a 2% increase from 2021.

Author(s): Jennifer Johnson

Publication Date: 11 July 2023

Publication Site: NAIC Capital Markets Bureau