Link: https://content.naic.org/sites/default/files/capital-markets-special-reports-PE-owned-YE2021.pdf

Graphic:

Excerpt:

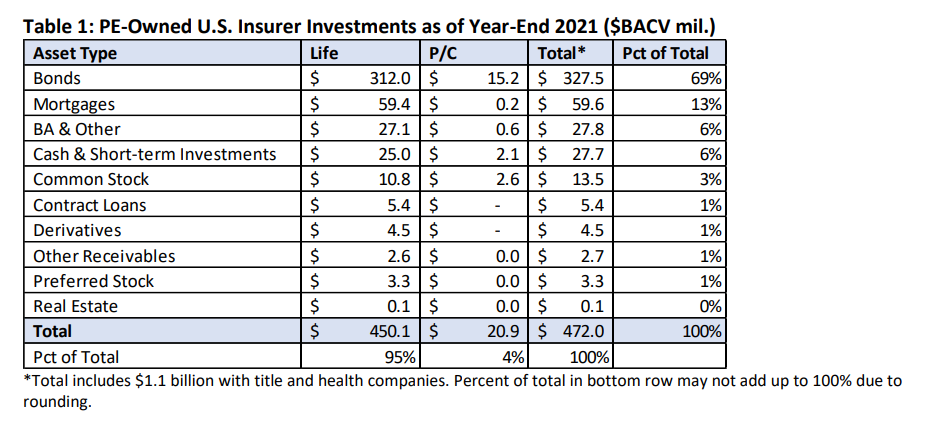

The BACV of total cash and invested assets for PE-owned insurers was about 6% of the U.S. insurance

industry’s $8.0 trillion at year-end 2021, down slightly from 6.5% of total cash and invested assets at

year-end 2020. The number of PE-owned insurers, however, increased to 132 in 2021 from 117 in 2020,

but they were about 3% of the total number of legal entity insurers at both year-end 2021 and year-end 2020.Consistent with prior years, U.S. insurers have been identified as PE-owned via a manual process.

That is, the NAIC Capital Markets Bureau identifies PE-owned insurers to be those who reported any

percentage of ownership by a PE firm in Schedule Y, and other means of identification such as using

third-party sources, including directly from state regulators. As such, the number of U.S. insurers that

are PE-owned continues to evolve.1

Life companies continue to account for a significant proportion of PE-owned insurer investments at

year-end 2021, at 95% of total cash and invested assets (see Table 1). This represents a small decrease

from 97% at year-end 2020 (see Table 2). Notwithstanding, there was a slight increase in PE-owned

insurer investments for property/casualty (P/C) companies, to 4% at year-end 2021, compared to 3% the

prior year. In addition, there was also a small increase in total BACV for PE-owned title and health

companies’ investments, at about $1.1 billion at year-end 2021, compared to under $1 billion at yearend 2020.

Author(s): Jennifer Johnson and Jean-Baptiste Carelus

Publication Date: 19 Sept 2022

Publication Site: NAIC Special Capital Markets Reports