Link: https://content.naic.org/sites/default/files/capital-markets-hot-spot-equity-markets-may2022.pdf

Graphic:

Excerpt:

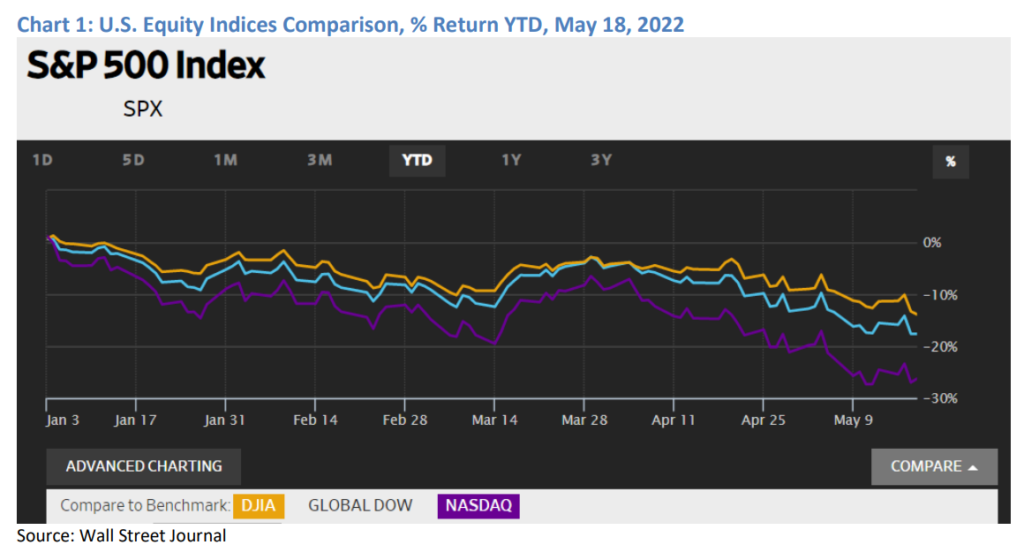

On May 19, the S&P 500 opened the day near bear market territory; i.e., at a 20% drop from a recent

high. On May 18, the S&P 500 experienced a 4% decline—the largest single-day decrease since June 2020. The last time the S&P 500 entered bear market territory was in March 2020, albeit short-lived, as

the market turned around and headed into a two-year rally that peaked in early January 2022.

The current equity market losses (and some corporate bond losses) are primarily the result of several

factors: 1) earnings reports from large American retailers, including Walmart and Target, show evidence

that the continued high inflation rate may be affecting consumer demand; 2) the war in Ukraine has

added to inflationary pressures, prompting the Federal Reserve (Fed) to increase interest rates and

reduce bond holdings; and 3) recent COVID-19 shutdowns in China have led to a slowdown in the

world’s second largest economy.

Author(s): Jennifer Johnson and Michele Wong

Publication Date: 19 May 2022

Publication Site: NAIC Capital Markets Special Report